Equity Crowdfunding ‘Rules’: Compliance with Mandated Ongoing Financial Reporting in an Unenforced Environment

with Greg Burke

Work in Progress

BibTeX citation available here. Contact me for a recent draft.

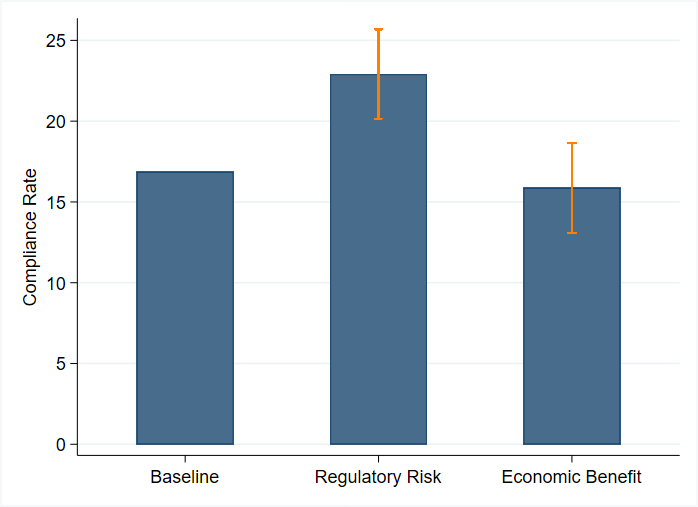

Abstract: Equity crowdfunding (ECF) is an emerging capital market in the U.S. where start-ups publicly issue unregistered securities under Regulation Crowdfunding (Reg CF) which requires minimal annual financial reporting following the offering. And with billions of dollars invested by millions of investors, less than half of issuers comply with this seemingly minimal annual reporting mandate and with only a third issuing timely. We show tardy filings are partially explained by the desire to issue additional securities. Using a randomized intervention, we find compliance increases from email reminders that emphasize the regulatory risk of non-compliance, but no distinguishable effect among issuers presented with potential economic benefits of compliance. This paper provides the first evidence on reporting compliance behaviors of ECF issuers in this mandated, but largely unenforced environment.